After saving up to purchase a new home, getting pre-approved, and making a down payment, it's hard for buyers to accept that they'll have additional out-of-pocket expenses. The escrow company is the neutral third party between the buyer and seller. They hold the buyer's deposit and distribute funds to all related parties once the sale of your home is official.

Some of these include paying off your mortgage, real estate agent fees, and property taxes. The escrow company charges a fee for doing this, which can be based on a percentage of the purchase price or a flat fee. You'll see this on your closing statement as a cost that is deducted from your net proceeds. We include every possible fee that you could be charged when closing a home, including title insurance, inspection fees, appraisal fees and transfer taxes. In fact, we replicate an entire Loan Estimate that you would get from a potential lender for your specific area.

We track the cost of each fee by city and state to give you the best estimate on closing costs. Costs vary by location, and sometimes buyer closing costs can be negotiated and paid for by the seller. Sellers may be responsible for paying liens on the property, property taxes, real estate commissions, title taxes, transfer taxes and utility bills that are past due. Additionally, up-front fees from your bank or mortgage company can add up quickly. According to data from Bankrate, New Jersey buyers pay an average of $863 in loan origination fees and $1,312 in third-party fees, for a total of $2,175. And this number doesn't include variable costs like title insurance, title search, taxes, other government fees, escrow fees, and discount points.

Closing costs are fees that must be paid in order to close your loan. "Closing costs" is actually a collective term that refers to all of the various fees buyers and sellers encounter during a typical real estate transaction. Any home loan — whether its to purchase a new home or to refinance a current loan — will come with closing costs.

Closing costs cover a variety of fees related to the processing of a mortgage and required prepaid items like homeowners insurance and property taxes. 4.Wrap the closing costs into the loan.You're already borrowing probably hundreds of thousands of dollars—why not tack on a few thousand more? Mortgage lenders charge more for this, but if you don't have the cash, it's a way to get into the house with less cash upfront. With this type of mortgage loan, the lender covers the fees, but you'll be paying a higher interest rate for the duration of the loan, which will mean larger mortgage payments. Did you know that you can get a mortgage loan or refinance your existing mortgage without having to pay any closing costs upfront? Some banks and lenders offer no-closing-cost mortgages and no-closing-cost refinances.

With this special type of loan, the lender bundles the closing costs of your mortgage directly into your principal balance. This means that you can pay the closing costs over time instead of having to pay them all upfront at closing. However, no-closing-cost mortgages typically have a higher mortgage interest rate compared to conventional mortgages.

This means that you will be paying more interest over time. The next section shows you a breakdown of prices for 13 typical closing costs. Whether you're a first-time homebuyer or have purchased property before, if you get a mortgage to buy a home, you'll have to pay closing costs. These fees, paid to third parties to help facilitate the sale of a home, typically total 2% to 7% of the home's purchase price. So on a $250,000 home, you can expect the amount to run anywhere from $5,000 to $17,500. The law also required GFEs for regular mortgages until 2015.

For most types of mortgages, a form known asthe Loan Estimatetook the place of the GFE on October 3, 2015. This three-page form gives you details about your loan, including the monthly payment, estimated interest rate and total closing costs. The lender must also provide this form within three business days of receiving your application. You should also receive a five-page document calleda Closing Disclosureat least three business days before closing on your mortgage loan. Down payments worth less than 20% of the total sale price of a home create additional risk for lending organizations.

As a result, lenders commonly call for private mortgage insurance to offset the consequences of default. If required, premiums are paid during closing, as part of the final settlement. Government-backed loans from the FHA and USDA also have mortgage insurance premium which is a parallel to PMI on conventional home loans, though the charges vary by loan type. Title Insurance/Settlement Services — Title companies work with lenders to finalize transactions, so the fees they charge are passed on to buyers.

In addition to title services, lenders typically require title insurance, to protect them from claims against the property. The lender's title insurance premiums are paid by buyers, despite the fact many are also responsible for providing their own version of coverage. When settlement requires attorneys, their itemized charges are outlined in closing documents and passed to buyers for payment.

Appraisal — The value of the property is central to each real estate transaction. Since the property itself serves as collateral for the loan, banks and other lenders do not want to extend financing that exceeds the value of the home. As a result, outside appraisals are ordered, for timely assessment of actual property values. When an independent appraisal fails to identify sufficient value in the property and structures present on a parcel, mortgage financing commonly falls through.

Alternatively, buyers can add larger down payments or seek terms with a different lender. The fees for appraisals generally pass through to the buyer, as part of the final reconciliation. It is important to remember appraisals have shelf lives, so they must be conducted within a particular time frame, relative to the sale. If a deal is delayed and cannot be closed in time, additional appraisals may be required, adding to the total closing tab.

The cost of each appraisal varies, based on the size of the property and the complexity of the valuation process. You don't need to worry about how your property taxes get paid when selling. The process of obtaining mortgage financing and transferring property ownership incurs costs, which must be settled, before a transaction is considered complete.

The total amount paid toward closing costs varies, according to conditions surrounding each deal, yet most buyers experience similar fees and charges. Generally, the total amount paid for closing a residential real estate deal represents less than 5% of the home's purchase price. Buyers and sellers share the burden of paying for closing costs at the end of a home sale, but they won't pay for the same things. In New Jersey, sellers typically pay for title and closing fees, transfer taxes, and recording fees at closing. Every home loan is financed through either a private bank, mortgage company, or non-profit credit union whether it's a government-backed loan or not. These businesses have overhead costs like employees and bank branches.

Therefore, a portion of your closing costs go towards paying these companies to handle your loan for you. Below are the common fees you can expect to be charged from your lender. Under Know Before You Owe, two required documents replace the four disclosure forms once used.

The third tab shows current local mortgage rates to help you estimate payments and find a local lender. A guide to better understanding closing costs is published below the calculators. Our guide also lists state-by-state average closing costs before and after taxes. These closing costs are an assortment of taxes and fees charged when home sales are finalized. Both buyers and sellers have closing costs that they are responsible for paying, but who pays for what is 100% negotiable. Transfer taxes are the taxes paid to local governments when the title of a home is transferred from the seller to the buyer.

These fees are paid to the county and city where the property resides, but not all counties and cities require them. The amount of these transfer taxes are based on a percentage of the sale price. You can check the percentage for your area, and then edit this field when using our house sale calculator to see how this will impact the net proceeds from your home sale. Sometimes referred to as reserve fees or prepaids, escrow funds hold reserved money for property taxes, premiums, homeowners insurance and mortgage insurance. The lender then uses the escrow funds to make payments on your behalf as part of your regular mortgage payment.

Closing costs are different for all home buyers as they are dependent on the price of the home, location, and other fees. All these factors make it very difficult to accurately determine closing costs, however, the average total closing costs for most buyers is 2% to 5% of the loan amount. For example, on a $400,000 loan, you can expect closing costs to be anywhere from $8,000 to $20,000. Therefore, our closing cost calculator can provide a much closer estimate as our calculator determines the individual costs based on your specific situation. As a buyer or seller of a property in New Jersey, you have to be prepared for closing costs.

This includes knowing what they are, how much they will be, and who will be responsible for paying them. Loan Origination Fee — Mortgage bankers are in business to generate profits, so services come with a price tag. The loan origination fee represents the charges imposed by a lender for extending mortgage financing. Once established, the fee must be included on the estimates provided to applicants and must also be accounted for on the final Closing Disclosure. Total fees are noted as a percentage of the value of a mortgage, or as a flat-rate cost of obtaining funding through a particular vendor. Lenders have discretion setting origination fees, so unlike some customary charges, there is room to negotiate and shop for better rates.

In fact, under certain circumstances, lenders will waive the origination fee, relying on the interest alone to remain profitable on a particular deal. An escrow account may be required to cover the future payments for items like homeowners insurance and property taxes. They do not represent fees; instead, they establish the funds needed to properly service your loan. The property taxes and homeowners insurance premium will be the same regardless of the lender you choose.

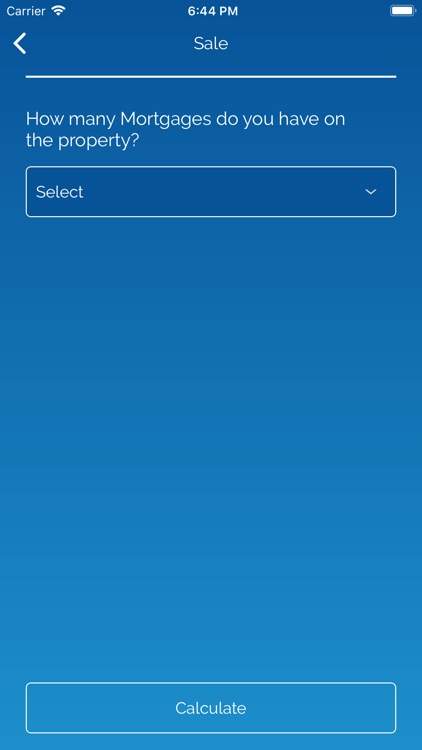

Use seller closing cost calculator to help estimate your closing costs and net proceeds from the sale of a home. You will need to know your closing date, sale price and information about your mortgages and other payments. Please remember that this is an estimate, the actual fees, expenses and final mortgage balances may change depending on a variety of factors including the actual closing date. If you want to avoid closing costs entirely, you may be able to secure what is called a no-closing-cost mortgage. While lenders will cover many of the fees that fall under closing costs, they will also charge you a higher interest rate for the loan. Your monthly payment will be larger, but you also won't have to spend as much money upfront, especially when you're also handing over a sizeable down payment.

Closing costs are an important cost in the process of buying a home and getting a mortgage. There are a few costs that are fixed, but a majority of them are variable where shopping around can get you a better deal. One of the largest closing costs is lender fees, especially origination charges, which can be close to 1% of the loan amount.

By shopping around for different lenders and with proper negotiations, these fees can be brought down significantly. There are a host of other variable fees where proper research and negotiation can save you a lot of money. Closing costs are the total fees that are paid for the services required when you purchase a new home or refinance your existing home. Closing costs are usually paid by the buyer of the home, but the seller pays some closing costs in the form of real-estate commission.

Similar to property taxes, Sautter says that sellers will also need to pay for public sewer proration and water fees. "Your real estate agent the water company to come out," on the closing date, he notes. Then the water company reads the meter and generates a final bill to be paid at settlement. Many factors influence the real amount that closing costs will set you back when you're buying or selling a house in New Jersey.

In general, the average you can expect to pay is usually between 2% and 3% of the total purchase price. Here is a more in-depth closing cost calculator which highlights individual fees you can expect to pay. This calculator allows you to select your loan type or if you will pay cash for the property. This is an estimate of how much you will need on the day your home purchase is made.

Please remember that this is an estimate, the actual fees and expenses may change depending on a variety of factors including the actual closing date. Below the calculator is a summary of the inputs and calculations used to create this estimate. The principal is the amount of money being borrowed, also called the loan amount. It's likely that you'll negotiate closing costs while negotiating your purchase agreement.

You may be able to get the seller to cover more of the closing costs if you forego certain repairs or agree to a quick closing. Buyers and sellers often negotiate the costs of things like home inspections, appraisal fees, title insurance, and attorneys fees. This is a common strategy employed by New Jersey home buyers looking for ways to reduce their closing costs. Check with your mortgage lender to find out if this is a viable strategy in your area. The escrow company handles all the funds involved in the transaction.

For example, at closing, the lender wires in loan funds and the buyer wires the down payment and closing costs. The escrow company then pays off any existing loans on the home, pays third-party service providers, and wires the rest of the funds to the seller. The escrow company also handles getting all of the loan documents signed and notarized. Sometimes called "real estate taxes," property taxes are typically billed twice annually. Along with homeowners insurance, property taxes can be paid in equal installments along with your monthly mortgage payment. This arrangement is known as "escrowing" your taxes and insurance.

Your origination fees , mortgage broker fee, and processing and underwriting are all part of your closing costs. Should you purchase a home via a VA loan, you will need to pay funding and VA appraisal fee. If you're buying a sponsor unit , it's customary for the buyer to also cover the seller's attorney fees in addition to the NYC and NYS Transfer Taxes. This is the reverse of a traditional private resale where sellers pay the Transfer Taxes and cover their own attorney fees. If a seller is motivated to offload their property, they might offer to pay the closing costs; sometimes that's in exchange for a higher sale price. This scenario gives buyers more breathing room when it comes to how much cash they need upfront.

However, in a hot sellers' market, fewer sellers are willing to cover closing costs. If you're selling your home in an area where competition for property is slow, you might need to take extra steps to seal your home sale. This might mean offering your buyer some money to cover their portion of the closing costs. If closing credits, also referred to as seller concessions, were part of your sale agreement, you'll need to pay for them at closing. The average total cost of closing fees for home-buyers is about $3,700.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.